Little Known Questions About Clark Wealth Partners.

Table of ContentsClark Wealth Partners Things To Know Before You Get ThisThe Ultimate Guide To Clark Wealth PartnersThe 9-Second Trick For Clark Wealth PartnersThe Buzz on Clark Wealth PartnersThe Facts About Clark Wealth Partners UncoveredThe 4-Minute Rule for Clark Wealth PartnersGetting My Clark Wealth Partners To Work

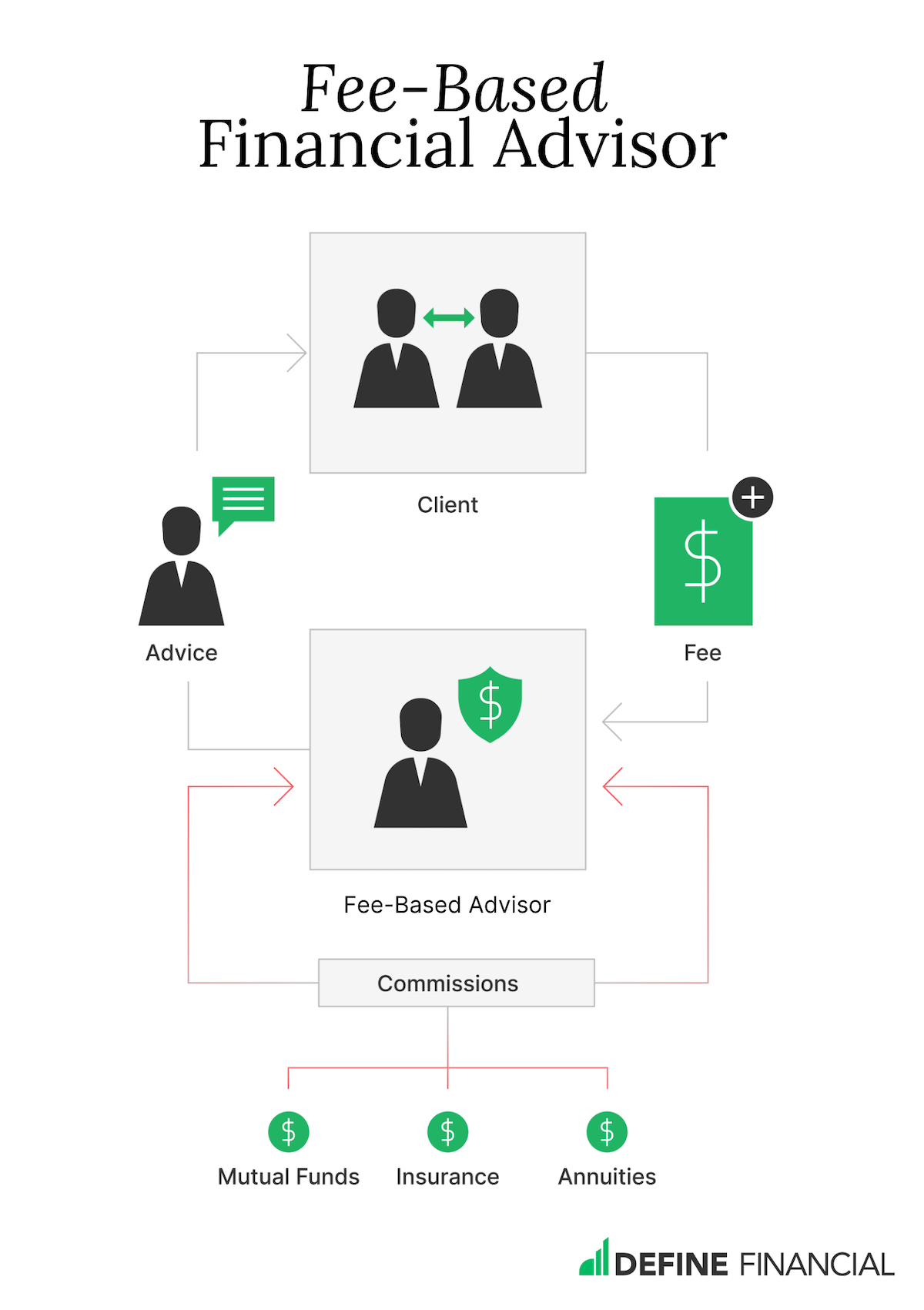

These are experts that offer investment suggestions and are signed up with the SEC or their state's securities regulator. Financial advisors can likewise specialize, such as in trainee fundings, elderly requirements, taxes, insurance and other elements of your funds.Yet not always. Fiduciaries are lawfully required to act in their customer's finest rate of interests and to maintain their cash and residential or commercial property separate from various other properties they manage. Just economic advisors whose classification requires a fiduciary dutylike certified economic coordinators, for instancecan state the very same. This difference also suggests that fiduciary and monetary advisor cost structures vary too.

The Facts About Clark Wealth Partners Uncovered

If they are fee-only, they're much more likely to be a fiduciary. Lots of qualifications and designations call for a fiduciary obligation.

Selecting a fiduciary will ensure you aren't steered toward particular financial investments due to the compensation they provide - st louis wealth management firms. With great deals of money on the line, you may want a financial professional that is legally bound to make use of those funds meticulously and only in your best passions. Non-fiduciaries might recommend investment products that are best for their wallets and not your investing objectives

What Does Clark Wealth Partners Mean?

Find out more now on just how to keep your life and savings in equilibrium. Increase in financial savings the typical house saw that dealt with a monetary expert for 15 years or more contrasted to a comparable house without a monetary consultant. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Value of Financial Advisors," CIRANO Job Reports 2020rp-04, CIRANO.

Financial guidance can be useful at turning factors in your life. Like when you're starting a household, being retrenched, intending for retirement or taking care of an inheritance. When you meet with an adviser for the very first time, exercise what you wish to obtain from the advice. Before they make any suggestions, an adviser must make the effort to review what is very important to you.

The Clark Wealth Partners Statements

When you have actually consented to go on, your monetary consultant will prepare a financial try this out prepare for you. This is offered to you at one more meeting in a file called a Statement of Suggestions (SOA). Ask the consultant to describe anything you do not comprehend. You ought to always feel comfy with your adviser and their suggestions.

Firmly insist that you are informed of all transactions, which you obtain all correspondence pertaining to the account. Your advisor may suggest a taken care of discretionary account (MDA) as a way of handling your financial investments. This includes authorizing a contract (MDA contract) so they can acquire or offer investments without needing to get in touch with you.

Some Known Facts About Clark Wealth Partners.

Prior to you purchase an MDA, contrast the advantages to the prices and dangers. To secure your money: Don't give your adviser power of lawyer. Never ever authorize an empty document. Place a time limit on any authority you provide to acquire and market financial investments on your part. Urge all document concerning your financial investments are sent out to you, not just your advisor.

This may occur throughout the conference or electronically. When you enter or restore the continuous fee setup with your adviser, they ought to explain exactly how to finish your relationship with them. If you're relocating to a brand-new consultant, you'll need to organize to move your financial documents to them. If you need assistance, ask your advisor to explain the procedure.

will certainly retire over the following decade. To load their footwear, the country will need greater than 100,000 brand-new economic consultants to get in the market. In their everyday work, financial consultants take care of both technical and creative jobs. United State News and Globe Record placed the duty among the leading 20 Ideal Company Jobs.

The Buzz on Clark Wealth Partners

Assisting people accomplish their economic goals is a monetary advisor's main feature. But they are also a local business owner, and a part of their time is devoted to managing their branch office. As the leader of their practice, Edward Jones financial advisors require the management skills to hire and manage staff, in addition to business acumen to produce and carry out a company approach.

Investing is not a "collection it and neglect it" task.

Financial consultants should set up time each week to meet brand-new people and catch up with the people in their ball. Edward Jones financial advisors are privileged the home workplace does the hefty lifting for them.

Indicators on Clark Wealth Partners You Should Know

Edward Jones financial advisors are urged to go after added training to broaden their knowledge and skills. It's likewise a good idea for financial advisors to attend industry meetings.